What are Mutual Funds?

Mutual Funds are investment vehicles which collect money from all the investors and invest in bonds, equities and/or money market instruments. These investors share a common objective, as in the kind of instruments the investment has to be made, or the combination of two or more kinds, or on the basis of risk profile. You can start your online mutual fund investment with just Rs. 500!!

This entire pool of money is managed by fund manager. He is the one who strategizes in order to make a particular mutual fund scheme a profitable bet. All these mutual fund scheme charge an expense, upto 1.5% of your invested amount, in order to pay the fund manager, and for their management plus miscellaneous expenses)

The profit or the returns generated from a particular instrument (after deducting the fees), is distributed on the proportionate basis, depending upon the online mutual fund investment amount.

Types of Mutual Funds

|

|

|

| Debt | Hybrid | Equity |

| Liquid Fund | Conservative Hybrid Fund | Index Funds |

| Ultra Short Term | Equity Saving Fund | Large Cap |

| Floater | Multi Asset Fund | Focused Equity |

| Low Duration | Dynamic Asset Allocation Fund | Large & Mid Cap |

| Money Market | Aggresive Hybrid Fund | ELSS |

| Short Term | Dividend Yield | |

| Medium Duration | Value / Contra | |

| Dynamic Bond | Multi Cap | |

| Corporate Bond | Mid Cap | |

| Credit Risk | Small Cap | |

| Banking & PSU | Sectoral / Thematic | |

| Long Duration | ||

| Gilt Fund | ||

However, you can subscribe for closed ended funds only in the initial offer period, and redeem only after the maturity date.

In case of ‘Passively’ managed fund, the fund manager does not reason much when it comes to making investment choices. He/ She simply follows the index.

Online Mutual Fund Investment Vs Other Investment Options

Mutual Funds are no doubt better than other investment options, mainly because of following reasons:

• Online Mutual Fund Investment offer better returns than traditional investment options

• Mutual Funds are simple and best modes of investment for those who lack huge amounts of money and/or don’t have time to do research on the financial instruments.

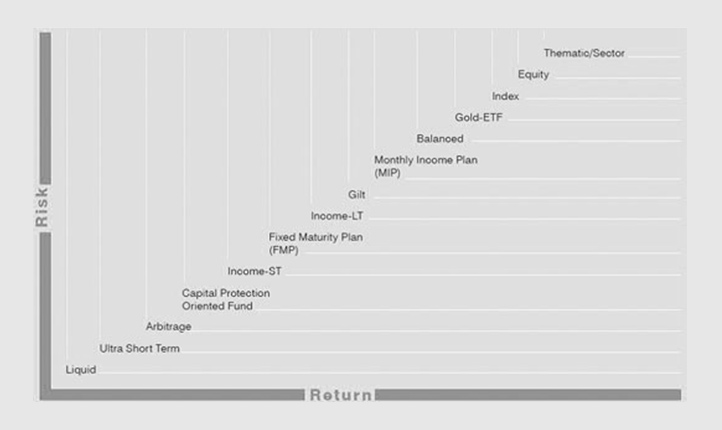

• You can choose from a variety of schemes depending upon your risk profile.

How to grow

money with Mutual Funds?

How a mutual fund performs depends much on the fund manager. Which stocks he chooses for investment, when to hold, when to buy and when to sell – are the important drivers for growth of any mutual fund.

Then there are bunch of other reasons as well; how is the country’s economy doing? And what is the general sentiment in the country?

Further, if an investment has to be done in mutual fund schemes, make sure that the investment is at least for 3 years.

Also there are short term factors like market sentiments, elections, because of which indexes are not stable. Herein lies the opportunity to gain. Because of this very ‘volatile’ nature of market, mutual funds, especially equity mutual funds’ NAV tend to fluctuate.

You can invest when the market is low and redeem when the market is high.

Why you need a Mutual Fund Advisor?

Trusting someone with your hard earned money is difficult indeed.

Choosing a scheme out of 18000+ schemes is worse.

When you are investing, the kind of scheme you are putting in your money matters the most. It is extremely important to know how much risk you are ready to withstand, which again depends upon multitude of factors.

Also, with time, portfolio rebalancing is important. How much should be allocated to debt, and how much should be put in equity and with time making sure that the ratio is maintained, is a mountainous task.

Here is where the financial advisor comes in.

A qualified advisor (Certified Financial Planner), are better in money management than non professionals in this area. Your advisor will take care of your money, your taxes, and will be answer to all your questions like where and when to invest?

There are some miscellaneous services for which your advisor is responsible; like change of address, email id’s, capital gains statement, portfolio performance, etc. Not everyone can make their investments alone mainly because of the time constraint or/and the inclination in the research part.